FundSpec: Stock Market Quotes app for iPhone and iPad

Developer: Vembar, LLC

First release : 22 Feb 2019

App size: 47.28 Mb

Realtime Quotes, Unusual Options Alerts/Earnings/Price/Analyst Notifications, Discounted Cashflow, Relative Value, Scenario Analysis and Deep Learning Momentum Models all in one app!

Make use of our full suite of fundamental and technical analysis tools to find your next investment idea. Our various models provide the ideal tools for investors seeking alpha in todays complex financial markets. Build sophisticated financial models in simple, easy steps! Invest in the stock market with confidence!

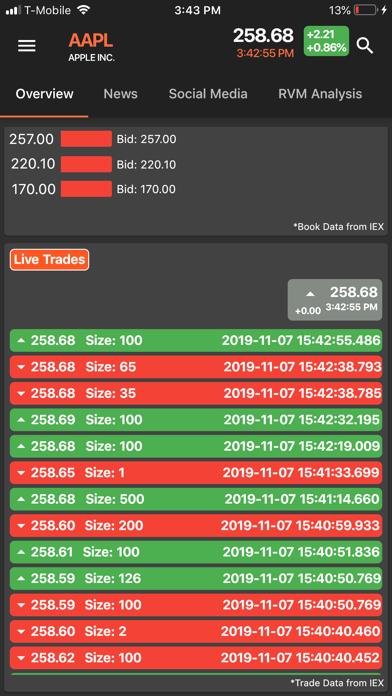

REAL TIME QUOTES & PRICE, EARNINGS, OPTIONS & ANALYST RATINGS ALERT NOTIFICATIONS

• Over 5000 US Equities

• Over 2000 ETFs

• Over 1500 Crypto Currencies

• Over 175 Currency Pairs

• Commodities

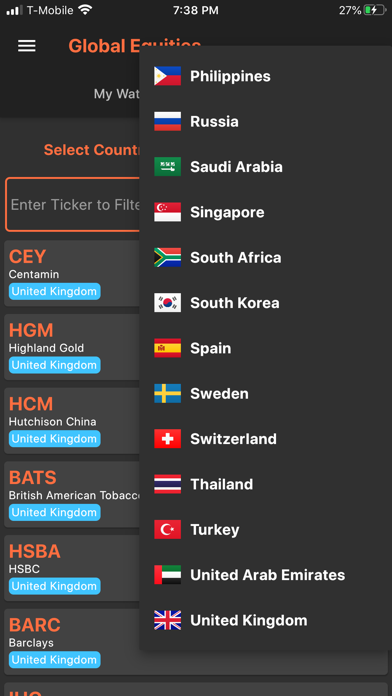

• Global Equities from over 30 countries

FINANCIAL NEWS & SENTIMENT

FundSpec gives you access to the latest financial news on stocks, currencies, crypto & commodities. Use our sentiment models to gauge news sentiment and investor sentiment on social media.

FUNDAMENTAL ANALYSIS

FundSpec has all the data you need to analyze your favorite stocks. Review all the data we have to offer to analyze the financial health of the companies before making your next investment.

• Analyst Price Targets & Ratings

• Consensus Earnings Estimates, Earnings Surprise & YOY Performance

• Upcoming Earnings Reports

• Insider Transactions

• Top Institutional & Fund Holders

• Fundamental Metrics over a dozen categories & Financial Data from the companys SEC Filings

TECHNICAL ANALYSIS

FundSpec offers over a dozen technical indicators as well as open high low close (OHLC) charts, moving averages and pivot points.

FINANCIAL MODELS

FundSpec gives you access to our unique Relative Value Model which determines fair value based on a cohort of comparable companies with business fundamentals most similar to the target company in a large N-dimensional feature space of fundamental features. We also offer Sector & Industry RV Models that compare a stock to a cohort of companies just in its industry or across its entire sector.

We have also trained a Deep Neural Network (DNN) to identify bullish/bearish patterns based on 20 years of price action and volume data over hundreds of stocks and its output is captured in our Momentum Model.

Looking to build your own custom models? FundSpec lets you do that too

• Discounted Cashflow Models (DCF): Single/multi-stage models with custom terminal values based on exit multiples (Price/Earnings, Price/Sales, Price/FCF).

• Relative Value Models: Build relative value models either by specifying the comparable companies or using our sophisticated algorithm to determine the cohort of companies.

• Scenario Analysis Models: Specify multiple Bull/Bear scenarios

• Deep Learning Pattern Match Models: Neural Networks are a very powerful tool to find patterns in data. Build your own custom Deep Learning models to find patterns in price action and volume data of individual stocks in simple, easy to understand steps.

The App also supports an in-app purchase allowing you to purchase an auto-renewable FundSpec Unlimited monthly subscription for $4.99 per month. The payment will be charged to your iTunes Account at confirmation of purchase. This subscription will auto-renew automatically every month unless you disable it in your settings at least 24-hours before the end of the current period. You can manage your subscription and auto-renewal can be turned off after purchase by going to your Account Settings. We also offers a free one week trial to new subscribers. If you do not cancel your subscription 24-hours prior to expiration of the free trial, you will be charged the monthly fee for the next period. For more information, please see our terms of use at https://fundamentalspeculation.io/termsofuse.